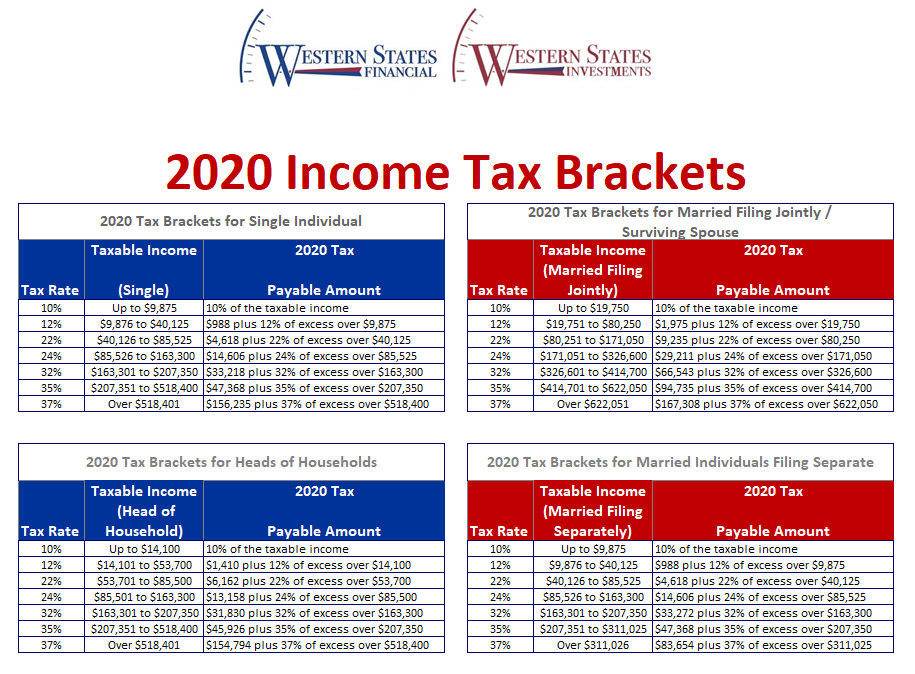

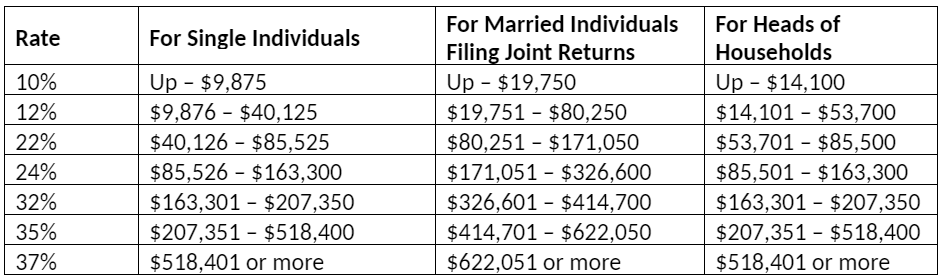

The remaining amount between $40,526 and $55,000 is taxed at 22%.īelow are the tax rates for 2021 and 2020. If you’re a single filer and your 2021 taxable income is $55,000, $9,950 is taxed at 10%. The federal tax brackets are progressive. You have four filing statuses to choose from: single, married filing jointly, married filing separately, or head of household. Each rate applies to its own tax bracket and is based on your filing status. Here’s a breakdown of the key tax elements affecting your 20 tax returns. Remember, you file your 2020 tax return in 2021 and your 2021 tax return in 2022.įederal tax brackets & rates for 2020 & 2021Īt the federal level, there are seven tax brackets that range from 10% to 37%. " Retirement Savings Contributions Credit (Saver’s Credit).Each year, new tax rates are created, income thresholds are updated, and credits and deductions are renewed. Pay attention to these numbers early in the year to outline your tax strategy and make the most of any and all possible tax benefits. " Amount of Roth IRA Contributions That You Can Make for 2022." " Amount of Roth IRA Contributions That You Can Make For 2021." " IRS Announces 401(k) Limit Increases to $20,500." " 2021 IRA Deduction Limits - Effect of Modified AGI on Deduction if You Are Covered by a Retirement Plan at Work." " Retirement Topics - IRA Contribution Limits." " Retirement Topics - Catch-Up Contributions." " The Child Tax Credit," Select, "Can I Get More of the Child Tax Credit in a Lump Sum When I File My 2021 Taxes Instead of Getting Half of it in Advance Monthly Payments?"

/GettyImages-1172587375-3243342d9f6f470788bd677084227fa7.jpg)

#Us tax brackets 2020 archive

" Publication 972, Child Tax Credit and Credit for Other Dependents: Archive 2018," Pages 1 and 9. How does the first phaseout reduce the 2021 Child Tax Credit to $2,000 per child? (added June 14, 2021)."

" 2021 Child Tax Credit and Advance Child Tax Credit Payments - Topic C: Calculation of the 2021 Child Tax Credit," Select, "Q C4. " Families Will Soon Receive Their December Advance Child Tax Credit Payment Those Not Receiving Payments May Claim Any Missed Payments on the Upcoming 2021 Tax Return." " IRS Updates the 2021 Child Tax Credit and Advance Child Tax Credit Frequently Asked Questions, FS-2022-03,". " H.R.1319 - American Rescue Plan Act of 2021." " Earned Income and Earned Income Tax Credit (EITC) Tables: EITC Tables," Select, "Tax Year 2021." " Publication 5307, Tax Reform Basics for Individuals and Families,". " IRS Provides Tax Inflation Adjustments for Tax Year 2022." Now, the credit is fully refundable for that amount in 2021. The maximum refundable portion of the child credit for each child under age 17 was limited to $1,400 per child. The age limit for qualifying children also rose to 17 (from 16).

It increased to as much as $3,000 per child ($3,600 for ages 5 and under). President Biden's American Rescue Plan made changes to the Child Tax Credit for 2021. The size of the earned-income tax credit also increased for childless households only for the 2021 tax year to $1,502. For single filers, the phaseout percentage rises to 15.3%, and phaseouts increase to $11,610.

The age range expanded so people without children can claim the credit as of age 19, instead of 25, with the exception of certain full-time students (students between 19 and 24 with at least half a full-time course load are ineligible). The American Rescue Plan, signed by President Biden on March 11, 2021, includes generous tax breaks to low- and moderate-income people.

0 kommentar(er)

0 kommentar(er)